Are you taking full advantage of your financial aid opportunities? If you have not yet applied for the Pell Grant, then you may be missing out on millions in federal funding that is currently being unused. In fact, in California alone, more than 500,000 community college students were eligible for the Pell Grant, but simply did not apply for it, according to the Institute for College Access and Success.

As a grant, the Pell Grant does not need to be repaid, making it one of the best financial aid opportunities. In addition, the Obama administration plans to inject another $40 billion into the program, as reported by the Washington Post.

College Scholarships explains the Pell Grant as follows:

"What we know today as the Pell Grant, began as the Higher Education Act of 1965. Proposed by then President Lyndon Johnson and passed by Congress, the HEA provided financial aid to students from low income families who would otherwise have been unable to afford a college education. In 1972 the HEA was reformed under the oversight of Senator Claiborne Pell. The Higher Education Amendments of 1972 reauthorized the original act, while further alterations and amendments made in 1978 helped to form what we now recognize as the federal Pell Grant program. During the amendments of 1978 the program was renamed to honor the dedication of Senator Claiborne Pell in his pursuit to provide access to higher education for the nation’s low income students."

This video explains Pell Grants.

Understanding the Pell Grant

According to the U.S. Department of Education, the Federal Pell Grant is a needs-based program that provides financial aid to low-income undergraduate students. You are eligible for the grant if you have not yet received a bachelor’s degree or another professional degree, and if you meet financial criteria based on several factors:

- Expected family contribution

- Family size

- Student’s income

- Cost of attending the community college

- Enrollment status and timeline

In roughly evaluating whether or not you would qualify for the Pell Grant, 57% of Pell Grant recipients in 2005 – 2006 had family incomes of less than $20,000 annually, while 90% of Pell Grant recipients in 1999 – 2000 were from families with income less than $41,000 per year. However, if your family income is less than $60,000, you are technically eligible for Pell Grants.

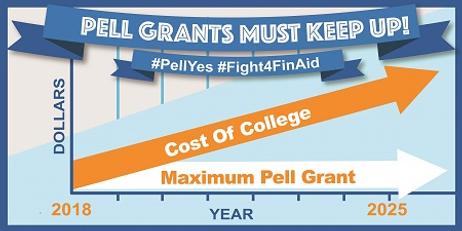

As “free” money, the Pell Grant can provide you with a generous sum of money for your community college education. During the 2003 – 2004 school year, the average Pell Grant award was $2,466, but this is far below the maximum award, according to the College Board’s Pell Grant Status Report. For the 2009 – 2010 school year, the maximum award is $5,350. This will grow to $5,550 for the 2010 – 2011 school year. Under Obama’s administration proposal, the future awards will be tied to the consumer price index and a cost-of-living scale, which will raise the maximum award, even more, starting in 2013.

Unexpected Benefits of the Pell Grant

In addition to the funding you receive directly through the Pell Grant, there is another side benefit: more aid through other programs. In fact, several other grants are specifically tied to your eligibility for the Pell Grant. For example, if you are a Pell Grant recipient, you are a priority candidate for the Federal Supplemental Educational Opportunity Grant. There are other grants and loans available that give special consideration to those who are Pell Grant recipients, and if you don’t apply for the Pell Grant, you could likely be missing out on other financial aid opportunities as well.

Beyond the financial benefits, Pell Grants are also associated with improved academic performance. According to a statistical analysis report by the National Center for Education Statistics, Institute of Education Sciences, the “receipt of a Pell Grant is actually associated with a shorter time to degree.” In addition, in comparison to those who did not receive a Pell Grant, students were more likely to “have higher aspirations for graduate school enrolment in the future, if they were not already enrolled.”

Steps to Applying for a Pell Grant

Applying for a Pell Grant is a simple and easy process. You will first need to fill out the Free Application for Federal Student Aid (FAFSA). Once you have filed the FAFSA, your community college will receive an Institutional Student Information Record, which will detail your Pell Grant eligibility. Your community college will then dispense the Pell Grants, either by crediting the funds to your account or paying you the grant in full by check. If you qualify, obtaining these free funds is that easy!

Too much Pell Grant money goes unclaimed. If you are financially eligible, take advantage of the Pell Grant today to help fund your community college education.

Questions? Contact us on Facebook @communitycollegereview.